A Transaction-level Internal Control Activity Is Best Described as

What youll learn to do. An action taken by client personnel for the purpose of preventing detecting and correcting errors and frauds in transactions to eliminate or.

What Are Internal Controls Types Examples Purpose Importance

The frame work can also help the regulators manage shareholders expectations as regards internal control over financial reporting.

. 2 provide reasonable assurance that transactions are recorded as necessary to permit preparation of. Internal control monitoring assesses the quality of performance over time and resolve the findings of audits can and other reviews. Strategic highest level operational mid-level and tactical low level.

A transaction-level internal control activity is best described as An action taken by client personnel for the purpose of preventing detecting and correcting errors and frauds in transactions to eliminate or mitigate risks identified by the company. Maintaining accountability for the use and custody of resources involves assigning specific responsibilities to specific individuals. The objectives of internal control vary depending on the method of data processing used.

An action taken by auditors to obtain evidence. A transaction-level internal control activity is best described as A. A transaction-level internal control activity is best described as a.

Education and Training 3. A well-designed system of internal controls will prevent or detect all errors and fraud. A5 Internal control over financial reporting is a process designed by or under the supervision of the companys principal executive and principal financial officers or persons performing similar functions and effected by the companys board of directors management and other personnel to provide reasonable assurance regarding the reliability of financial reporting.

Inherent limitations of internal control preclude a system of internal control from providing absolute assurance that objectives will be achieved. At Deloitte we assist companies and regulators in performing the following 1. OCC examiners will assess and draw conclusions about the adequacy of a banks internal control during every supervisory cycle.

An action taken by client personnel for the purpose of preventing detecting and correcting errors and frauds in transactions to eliminate or. Technology can identify conditions and circumstances that indicate that controls have failed or risks are present. He enlists the help of the companys officers to decide.

Of bank activities internal controls and management information systems to help the board and management monitor and evaluate internal control adequacy and effectiveness. An action taken by auditors to obtain evidence. Describe the different levels and types of control.

Resources include money equipment supplies inventory and the records that account for these assets. Other transaction-level internal controls. Internal control systems should involve procedures to restrict access to and enhance control over resources.

In other words control activities are actions taken to minimize risk. Imagine the president of a company decides to build a new company headquarters. An action taken by client personnel for the purpose of preventing detecting and correcting errors and frauds in transactions to eliminate or mitigate risks identified by the company.

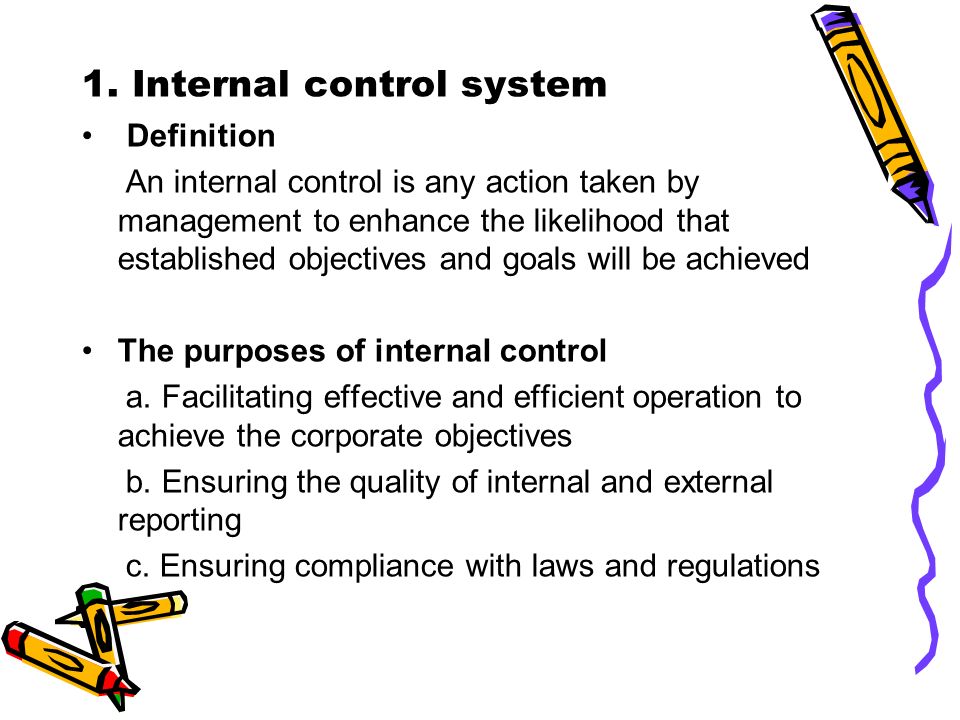

In management there are varying levels of control. An action taken by auditors to. Internal control is all of the policies and procedures management uses to achieve the following goals.

An action taken by auditors to obtain evidence. The auditor must issue an internal control report on the evaluation of internal controls overseen by the Public Company Accounting Oversight Board C. A transaction-level internal control activity is best described asa.

The need for a control activity is established in the risk assessment process. A transaction level internal control activity can be labeled as an action taken by the personnel of the client for the purpose of identifying preventing and rectifying errors and frauds in the recorded transactions so as to eliminate or diminish the. Controls remain aligned with changing objectives environment laws resources and risks.

Management of Johnson Company is considering implementing technology to improve the monitoring of internal control. Which of the following best describes how technology may be effective at improving internal control monitoring. Ensure the reliability and integrity of financial information - Internal controls ensure that management has accurate timely and complete.

The cycle memorandums and internal control questionnaires were crucial to the internal control assessment process because they outlined the sequence of processes used to establish identify assemble analyze classify and record a particular type or group of transactions. However appropriate SOD enforced by an ERP security system is one of a handful of foundational controls. A transaction-level internal control activity is best described as a.

An action taken by auditors to. A companys internal control over financial reporting includes those policies and procedures that 1 pertain to the maintenance of records that in reasonable detail accurately and fairly reflect the transactions and dispositions of the assets of the company. Safeguard University assets - well designed internal controls protect assets from accidental loss or loss from fraud.

An action taken by auditors to obtain evidence. An action taken by client personnel for the purpose of preventing detecting and correcting errors and frauds in transactions to eliminate or. As a result system access rights are poorly designed and SOD isnt used effectively.

Which of the following best describes these requirements. By working to establish appropriate SOD organizations can significantly improve their risk management. Implementation of COSO internal control framework 4.

Corrective actions are a necessary complement to control activities in order to achieve objectives. A transaction- level internal control activity is best described as. Consequently it is essential that a dynamic.

Control activities are the policies procedures techniques and mechanisms that help ensure that managements response to reduce risks identified during the risk assessment process is carried out. When planning the audit of internal controls for an issuer the audit team should. An action taken by auditors.

The auditor is required to only report weaknesses in the internal control design of the company he or she is auditing.

Adequate And Effective Internal Controls De Rebus

No comments for "A Transaction-level Internal Control Activity Is Best Described as"

Post a Comment